Top

Info

Life Planner by Assetview

Vitals

Vitals

Pricing

Pricing

Details

Details

Plan Your Best Future

See how small adjustments today reshape your future

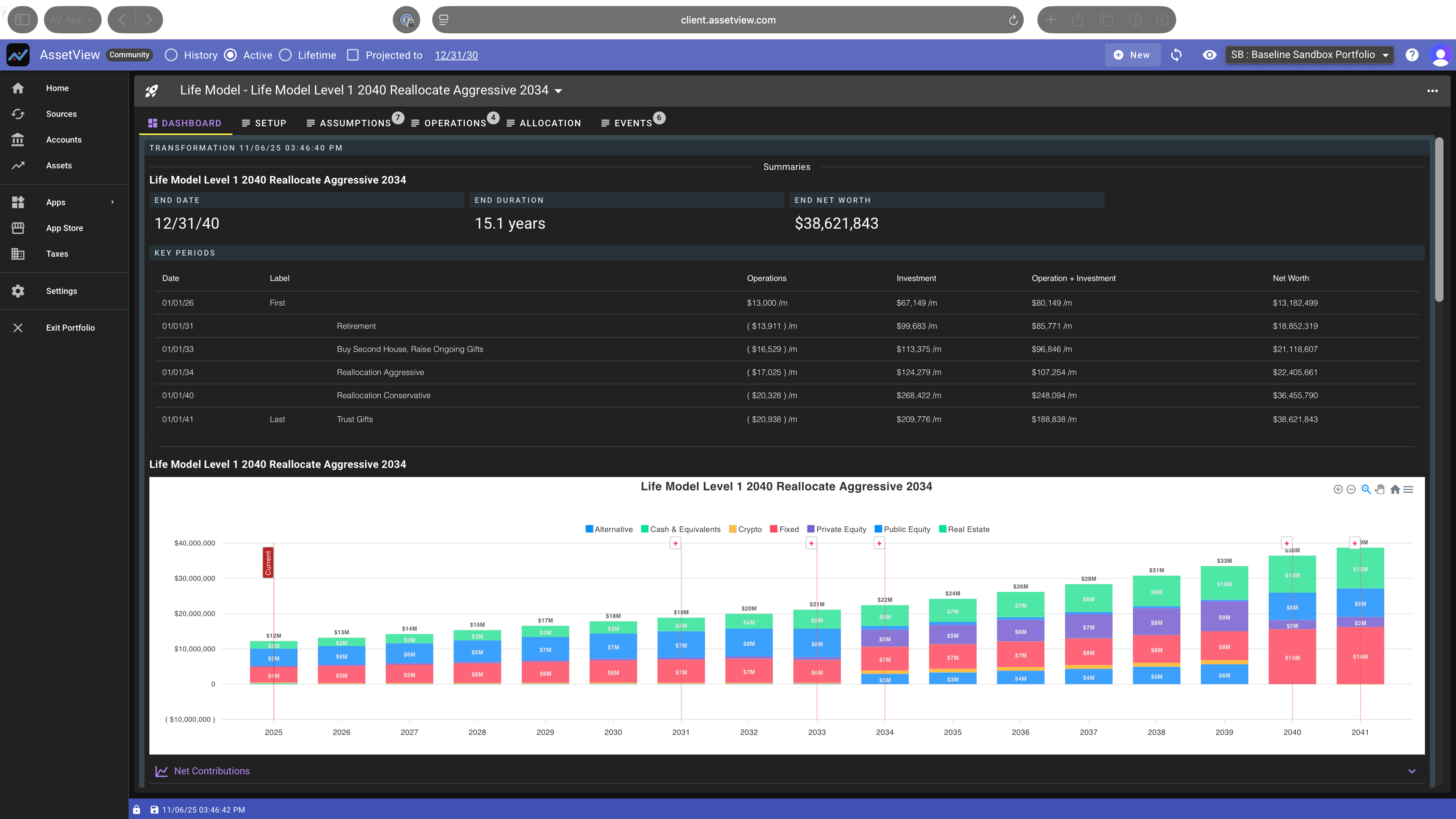

- Net worth trackingsee your net worth today and how it evolves on any future date

- Achievementspinpoint when your net worth will exceed $N

- Retirementknow when you can retire with confidence

- Investment planningassess the feasibility of milestones like buying a second home or funding major investments

- Passive incomeknow when your passive income will surpass $N

- Buying powertrack your inflation-adjusted buying power over time to protect long-term wealth

- Scenario testing by rates of returneasily explore what-if scenarios rates of return per asset class change over time

- Scenario testing asset class allocationseasily explore what-if scenarios by adjusting allocations per asset class over time

- Scenario testing sector allocationseasily explore what-if scenarios by adjusting allocations per sector (e.g. technology, healthcare) over time

- Scenario testing geographic allocationseasily explore what-if scenarios by adjusting allocations by geography (e.g. North America, Asia) over time

- Scenario testing risk allocationseasily explore what-if scenarios by adjusting allocations by risk profile

- Scenario testing by attributedefine your own attributes and easily explore what-if scenarios with levers that adjust each attribute

- Evaluate investment strategiesinstantly see the effects of reallocating, or shifting towards a more risk-averse or aggressive market posture

- Tax & liquidity planninganticipate upcoming tax obligations and ensure liquidity for commitments

- Personalizeuser attributes that enable you to filter and create views that match your unique financial goals

- Easebuilt on assumptions that you control with levers

- AutomaticLife Planner's models update automatically with new financial data to highlight what matters most to you

- AccuracyLife Planner can start with your real portfolio — not generic assumptions — so you get a true picture of where you're headed

- Adjustmentssee how small adjustments today reshape your future

- Visionsee the probabilities, the risks, and the possibilities so you invest with clarity, control, and confidence

🧩 Life Planner: Who It's For

👤 For Investors

Life Planner delivers clarity across your future financial picture. Project net worth across all asset classes, forecast when passive income surpasses expenses, and know exactly when you can retire or purchase a second home with confidence.

💼 For Financial Advisors

Life Planner transforms client prep and reporting. Go beyond past performance with forward-looking scenario planning. Run projections in real time and demonstrate when clients will reach their key milestones.

🏛️ For Family Offices

Life Planner simplifies multi-entity wealth planning. Map beneficiaries, trusts, and partnerships, while projecting tax liabilities, liquidity needs, and rebalancing effects. Plan not only for today but across generations.

The most useful planning tool on the market

✨ Price → free with your subscription to AssetView